broward county business tax receipt search

A business representative may submit your application in person on your behalf. Business Broward County Business Tax Receipt Search.

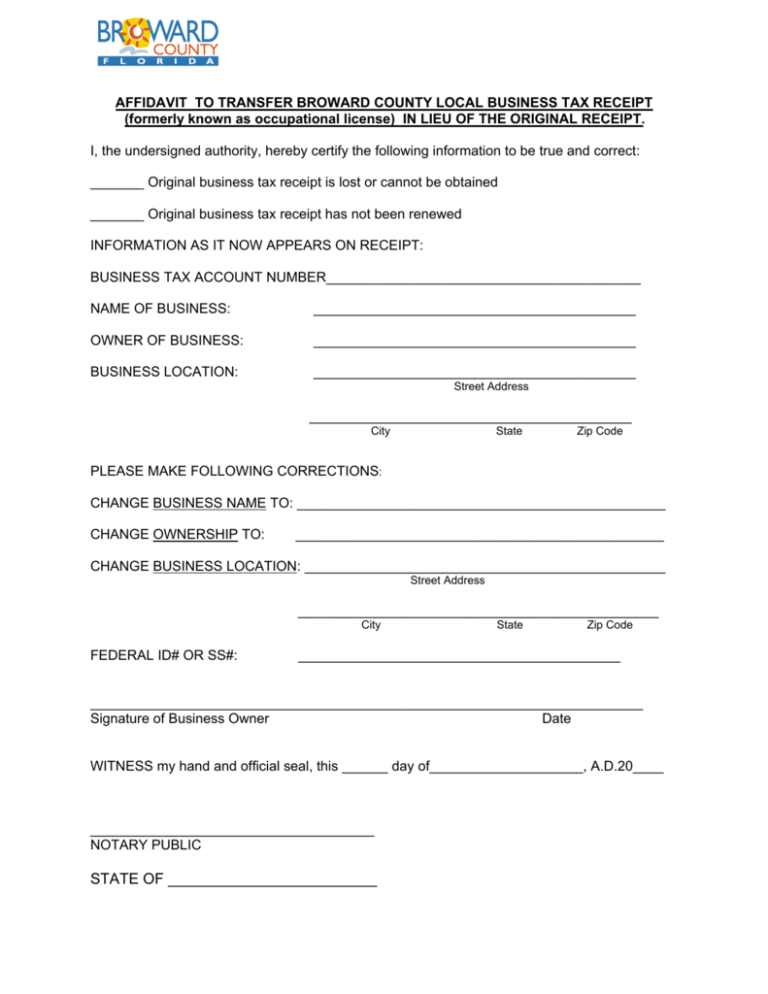

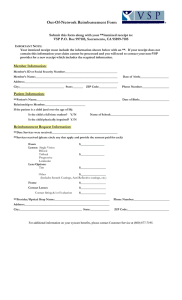

Affidavit To Transfer Broward County Local Business Tax Receipt

Categories include permits that small businesses often seek on their own.

. You can bring food snacks and drinks to. 9 hours ago Taxes And Fees Local Business Taxes Broward County. That Monday or the deadline falls on a Broward County State of Florida or national federal holiday the deadline will become 1159 pm.

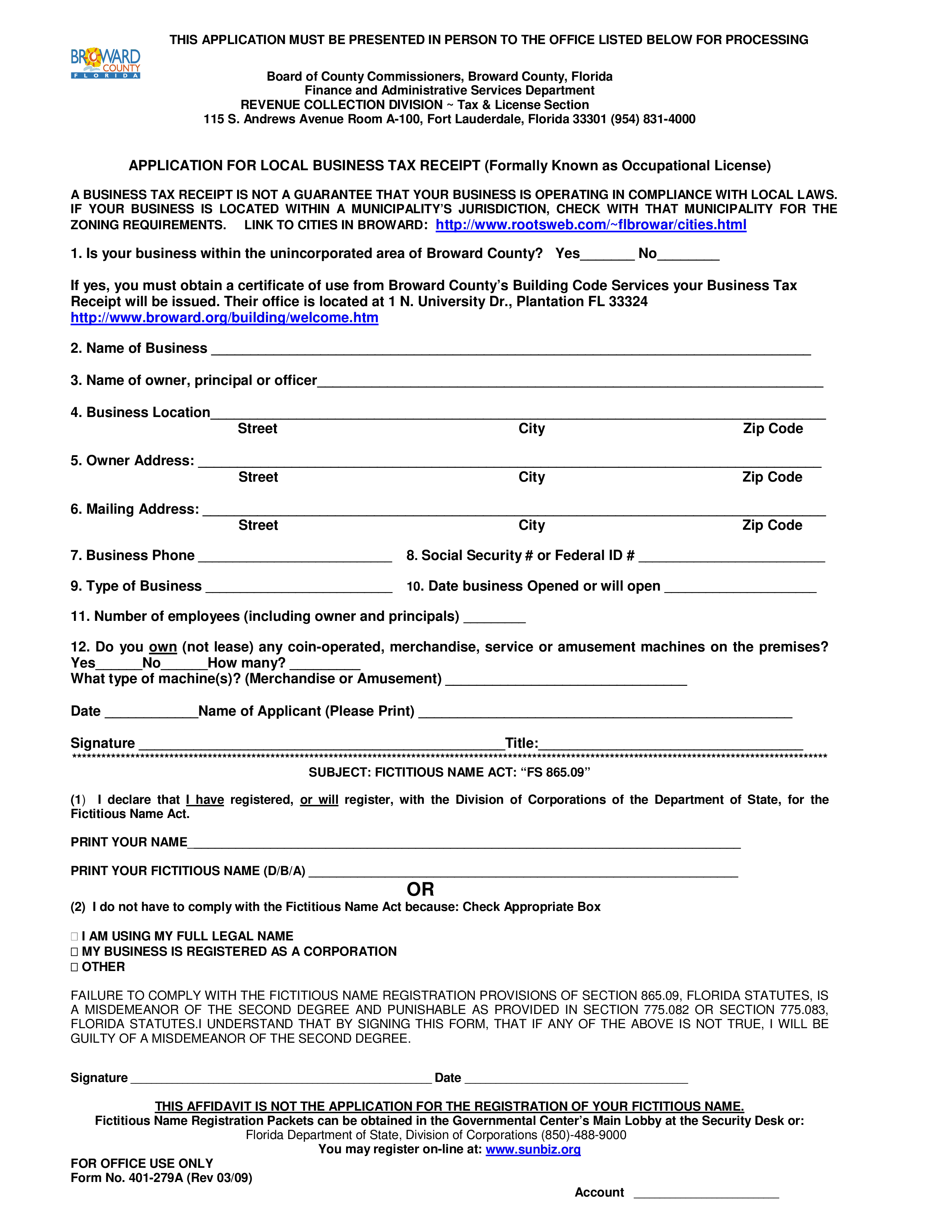

Name of owner principal or officer 4. The duties and authority of the County Recorder are established by state law. 2021 Property Tax Bill Brochure PDF 220 KB 2021 Taxing Authorities Phone List PDF 72 KB Frequently Asked.

A Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct. Return the bottom stub of your tax bill make check payable to Broward County Tax Collector paid in US. Some permit applications are required to be submitted by a licensed contractor or design professional.

When you pay a Local Business Tax you receive a Local Business Tax Receipt which is valid for one year from October 1 through September 30. For our office to notarize your document each party must have current government-issued picture identification such as a drivers license a state identification card or current. Welcome to Broward County BTExpress.

4 hours ago The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless. Grievance meetings shall be conducted during business operating hours and concluded by 500 pm unless the parties mutually agree to continue the meeting. Room A 100 Fort Lauderdale FL 33301.

Name of Business 3. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Tax payments are generally processed within 24 hours of receipt up to 3 business days during peak periods.

Broward County Records Taxes and Treasury Division 115 S. New businesses may also present applications for a Broward County Local Business Tax Receipt in person at Broward County Records Taxes and Treasury Division Governmental Center Room 115 S. Tom Kennedy Director 954-357-5777 Gary Mehringer Assistant Director 954-357-5440 Jeannie Terwilliger Recording 954-357-7274 Claudio Manicone Tax Deeds and Tangible Personal.

Small Business Useful for existing or new businesses. Use the buttons below to apply for a new Business Tax account and obtain your Broward County Business Tax receipt or request a change to your existing Business Tax account. 954-357-8170 8 hours ago Present your receipt for reentry if you leave and want to come back later.

For additional information and assistance please call 954-357-6200. Search all services we offer. Each owner must not have a personal net worth exceeding 1320000.

Of the following business day. For more information on the Records Taxes and Treasury Division visit our website. 1 2015 unpaid Business Tax Receipts for the 2015-16 year become delinquent and are subject to additional penalties and fees.

Robert Gleason Director Doing Business with Broward County General Purchasing 954-357-6070 Doing Business with Broward County General Purchas ing 954-357-6072 Records. If yes you must obtain a certificate of use from Broward Countys Building Code Services your Business Tax Receipt will be issued. Their office is located at 1 N.

Taxpayments for current taxbills are posted according to their postmark. Taxpayments are generally processed within 24 hours of receiptup to 3 businessdays during peak periods. Living in Broward Find Agencies Find Services Find Your District Find Parking Helpful References Volunteer Business Doing Business in Broward Find Agencies Services Find Your Commission.

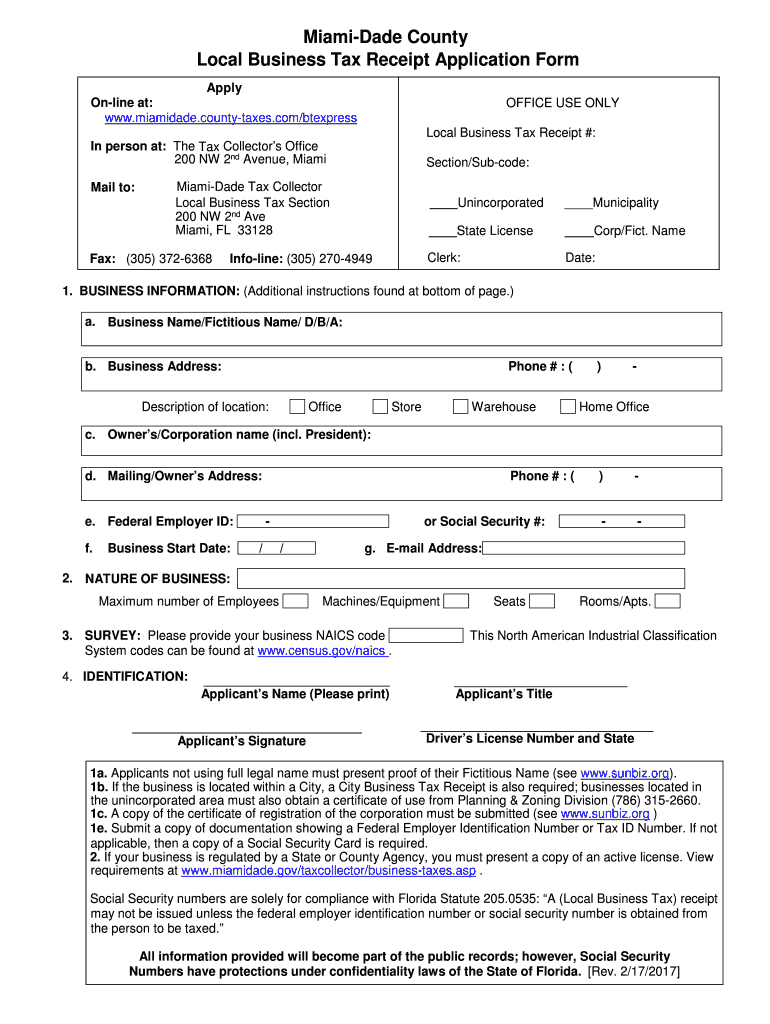

Each owner must not have a personal net worth exceeding 1320000. Local Business Tax Receipt Application Form PDF 135 KB Broward County - Fictitious Name Form PDF 223 KB List of Local Business Tax Receipt Categories PDF 72 KB Local Business Tax Receipt Exemption Application Form PDF 149 KB Property Taxes. Funds and payable from a US.

About Broward Countys Records Taxes and Treasury Division. The search results may not be a complete listing of the permits required for your project. Search all services we offer.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report. The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exempted. When you pay a Local Business Tax you receive a.

Duties and Authority of the County Recorders Office. Apply for a new account. 954-357-8170 Broward Broward County Search.

Living in Broward Find Agencies Find Services Find Your District Find Parking Helpful References Volunteer Business Doing Business in Broward Find Agencies Services Find Your. The vendor must have a Broward Business Tax Receipt and be located in and doing business in Broward County. By Using the Envelope Provided with your Tax Bill.

Taxes And Fees TaxBill information. Living in Broward Find Agencies Find Services Find Your District Find Parking Helpful References Volunteer Business Doing Business in Broward Find Agencies Services Find Your Commission.

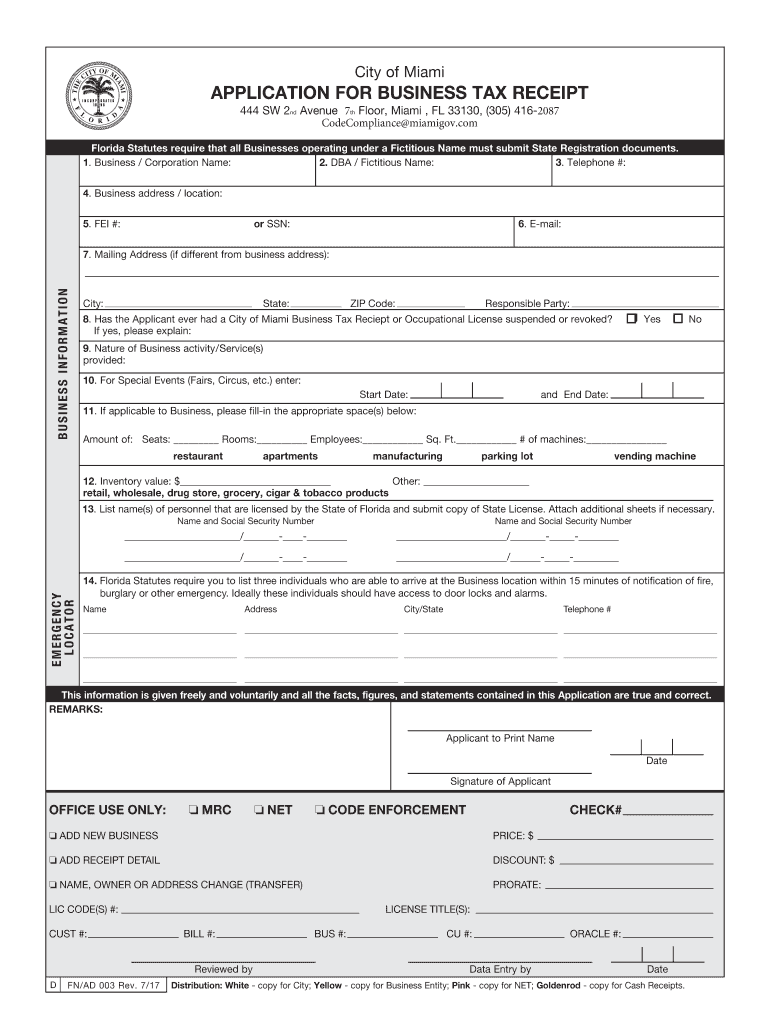

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

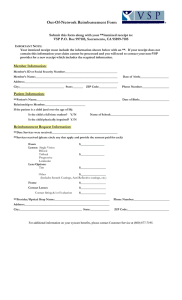

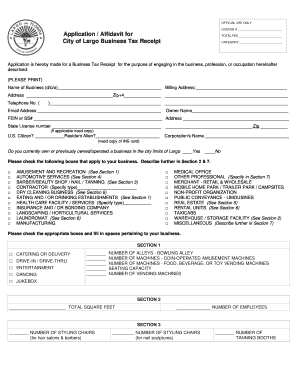

Get And Sign Largo Local Business Tax Polk County Form

Application For Local Business Tax Receipt Templates At Allbusinesstemplates Com

Business Tax Search Taxsys Broward County Records Taxes Treasury Div

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

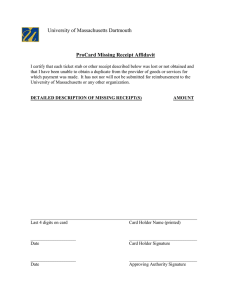

Affidavit To Transfer Broward County Local Business Tax Receipt

Affidavit To Transfer Broward County Local Business Tax Receipt

Affidavit To Transfer Broward County Local Business Tax Receipt

Cooper City Area Broward County Local Business Tax Receipt 305 300 0364